Introduction

The Chinese industrial robot market witnessed robust growth up to 2018, establishing itself as the world's largest and fastest-growing market. Within this sector, robotic arms, or manipulators, constitute the core hardware component for automation across manufacturing industries. This survey provides an overview of the domestic market for industrial robotic arms in China, based on data available until 2018.

Market Size and Growth (up to 2018)

According to data from the International Federation of Robotics (IFR) and Chinese industry associations, China's industrial robot installations continued to lead globally in 2018. While annual growth rates had moderated from the explosive pace seen earlier in the decade, the market maintained significant expansion. The demand for robotic arms was primarily driven by the automotive, electronics, and electrical appliance industries. Domestic production of robotic arms increased substantially, though foreign brands still held a significant share of the mid-to-high-end market.

Key Application Industries for Robotic Arms

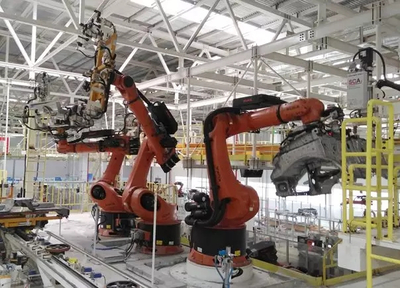

Automotive Manufacturing: Remained the largest application sector. Robotic arms were extensively used for welding, painting, assembly, and handling tasks.

Electronics Industry: A rapidly growing segment. High-precision robotic arms were employed for assembly, testing, packaging, and PCB handling of smartphones, computers, and components.

Electrical Appliances: Saw increasing adoption for tasks like assembly, polishing, and material handling in the production of white goods.

Metal & Machinery: Utilized for machine tending, casting, cutting, and grinding.

* Plastics & Chemicals: Primarily used for injection molding and palletizing.

Competitive Landscape (up to 2018)

The market was characterized by intense competition between international giants and rising domestic players.

- International Brands: Companies like Fanuc, Yaskawa, KUKA, and ABB dominated the market for high-performance, multi-axis robotic arms, especially in complex applications requiring high precision and reliability.

- Domestic Manufacturers: Chinese companies such as SIASUN, ESTUN, and GSK made significant strides. They competed effectively in the market for lower-to-mid range robotic arms, offering cost-effective solutions and improving technical capabilities. Government initiatives like "Made in China 2025" provided strong policy support for localization.

Technology and Product Trends (as of 2018)

Collaborative Robots (Cobots): A nascent but rapidly emerging segment. Robotic arms designed to work safely alongside humans began gaining traction in SMEs and for lighter assembly tasks.

Increased Payload and Reach: Demand grew for larger robotic arms capable of handling heavier payloads in industries like logistics and automotive.

Improved Precision and Speed: Technological advancements focused on enhancing repeatability and cycle times to meet the demands of electronics manufacturing.

Integration with AI and Vision Systems: While still developing, the integration of machine vision and rudimentary AI for guidance and quality inspection became an important trend, moving robotic arms beyond simple repetitive tasks.

Market Drivers and Challenges (Pre-2019 Perspective)

Drivers:

1. Rising labor costs and demographic shifts.

2. Government policies promoting industrial automation and smart manufacturing.

3. Demand for improved manufacturing quality and consistency.

4. The need for flexibility in production lines.

Challenges:

1. High initial investment costs for advanced robotic systems.

2. A significant shortage of skilled personnel for robot programming, integration, and maintenance.

3. Technical gaps between domestic and leading international brands in core components (e.g., precision reducers, controllers) and high-end models.

4. Integration complexities in existing, non-standardized factory environments.

Conclusion

As of 2018, China's domestic market for industrial robotic arms was in a phase of dynamic growth and transformation. While foreign brands maintained technological leadership, domestic manufacturers were rapidly closing the gap, supported by national policy. The market's expansion was fueled by fundamental economic factors and a strategic push towards advanced manufacturing. The trends toward collaboration, intelligence, and deeper industry penetration were firmly established, setting the stage for the market's evolution beyond 2018.